Between Friday and Monday mornings my razor stays neatly packed away in the commode. However, my father, Mr. Boomer, will shave at a minimum once a day (twice if there is an event he is attending). For me, the weekend summons my well worn Chacos, Old Navy shorts, and worn-out golf shits. The big man? Wouldn’t catch him wearing shorts in public on a 110-degree, saucy Florida day. It’s the culture.

How Gen Y fashion translates into the workplace is tricky. Each office is different. I remember just six years ago when I started here, two of the associates were still wearing ties every day. When the partners dropped the ties, so did the associates, unless we were out on an audit. How lawyers still suit up every day, I don’t know, but I believe change is coming for them. In the past six years, our unspoken dress code has become slacks and a button-down shirt. I have larger flags to fly than the clothes on my back. If the office is sparse on a Friday, I may rebel and wear jeans.

Trending forward:

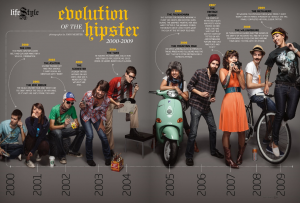

As I begin to work with clients with whom I want to work (Gen Y), I find that they are showing up to my office in shorts and cleavage. While neither of those bother me, I have not found the inner HIPSTER within me to let go and dress down. For those confused on what hipster fashion is, refer to my picture. It may or may not happen, but I can promise you, the topic does not keep me up at night. I feel the fashion expression is important to late Gen Y-ers and early Z-ers. I do believe as accounting becomes one of the only professions with job stability, we are going to encounter bright HIPSTERS who can bring something unique to the industry.

(Thinking on paper) I can’t remember the last time a client commented on my Van Hausen button down. I may reconsider my fashion options as I embark on my journey. (Thinking over)